Of Etds Return Preparation Software

Posted By admin On 14/03/18

Spectrum is a combination of Zen Income Tax Auditor Edition, Zen e- TDS, Zen Service Tax, Zen Document Manager, Zen Project Report / CMA, Zen Form Manager & Zen e- AIR. INCOME TAX AUDITOR EDITION Direct E-filing Facility Has Been Provided through Software. User Can Directly Upload The Xml File On The Income Tax Department's Site Through Software. Further A Facility Of 'Change Password' And 'Create User' Has Been Provided Through Software. User Need Not Log On To Department’s Site Manually. Features • Computation of Income and tax thereon taking care of statutory deductions, Set off of losses, Clubbing of Minor's income, Rebates etc. • Computation of Foreign Company and Non Residents and Trust has been provided with detailed provisions.

Contact us for ETDS Software, TDS Revised Return Software, eTDS Return Filing software, TDS Software. Maya 7.0 Crack [balistora] there. Preparation of depreciation chart. OFFICE UTILITIES. Oct 01, 2015 List of best software providers for preparation of e-TDS returns. JS @ eTDS is the best available tds software for generating eTDS returns.

• Automatic as well as manual calculation of interest u/s 234A, 234B & 234C. • Preparation of Return Forms viz. ITR 1 to ITR 7. • Preparation of Trading, P&L Account, Balance Sheet, Multiple Capital Account, and Statement of Affairs. • MIS Reports viz. Assesses register, Filed Return List, Pending Return List, Returns to be Prepared, Refund • Cases List, Advance Tax Register, Advance Tax Estimation Report, and Assesses without PAN etc.

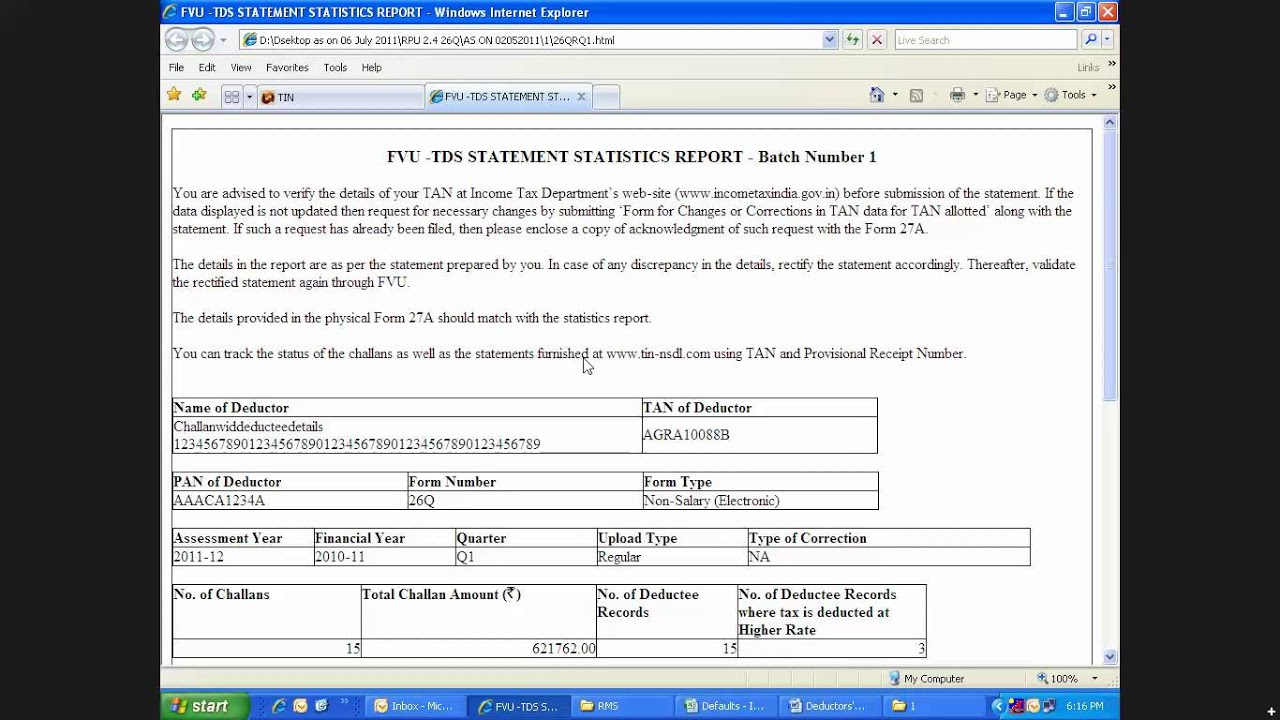

Saral TDS is specially designed for filling e-Return of TDS according to NSDL format. This software provides Easy to use Format where users can specify their TDS. Trouble shooting,step by step guide installation errors in NSDL eTDSTCS Return Preparation Utility. Lots of users switch to paid TDS return preparation software.

• Client-wise backup and restore facility. • Online e-Payment of Tax Challans through software directly, no require filling master information. • Facility to Import Data Directly from Tally 4.5/ 5.4/ 6.3/7.2/8.1/9.0, BUSY and from MS-Excel. • Specimen of Qualification in Auditor Report Notes on Accounts and Accounting Policies. • Facility to calculate Defer Tax Liability ⁄ Assets as per AS-22. • Statutory Compliance (Income Tax) » Enables Auto filing of Income Tax Return Form 1, 2, 2A, 3, 4, 4S, 5, 6 and 7 in Hard Copy and Electronic Format as per the requirement of Income Tax Department for Individuals, HUF, Firms, Companies, AOP, BOI, LLP and Trusts.

» Form 49A (PAN Application New-Indian Citizen), Form 49AA (PAN Application New-Foreign Citizen) & Form 49A Correction (Modification in PAN Data) are generated from the master database in the software in the hard copy and online. » Declaration form for Non deduction of TDS - Facilitates Generation of Form 15H (senior citizens) and Form 15G (Other Citizens).

» Relief Calculator - Calculation of Relief u/s 89(1). Minimum Alternate Tax (MAT) report - Furnishing of Form 29B enabled. » Advance Tax Calculator for computation of Advance Tax installments. • Billing » Facility to generate bills, receipts and bill cum receipts.

» Pending fee list and Pending bill list. » Client Ledger and Outstanding. • Various Online Activity (On Income Tax Website) » Navigating widget for logging on to Income Tax India website to directly upload the required XML files. » e-Filing for 10B, 10BB, 29B, 3CEB, 35. C Media Cm108 Drivers Windows 7 here. » Downloading widget facilitates update from email box i.e., downloading of intimation and ITR-V receipt status. » e-payment of Challan obviates need to fill master information, Import TDS entries from Form 26AS. » Facility to know Outstanding Tax Demand, Tax Credit Mismatch, Rectification Request, Filing of Defective Return, Generation & Verification of ITR through EVC.